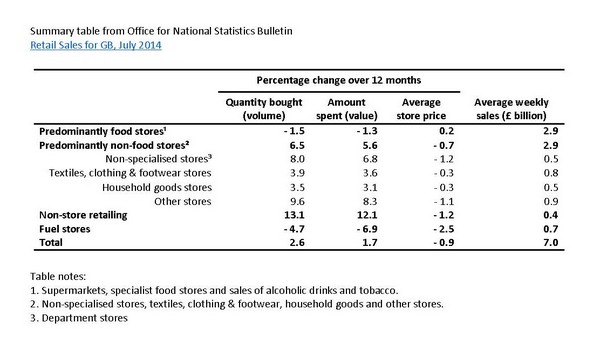

Last week the papers reported that for the first time since the monthly statistics were gathered (January 1989), the quantity of food sold in a particular month in GB fell when compared to the same month in the previous year. In July 2014 the quantity of food sold fell by 1.5% when compared to July 2013, sales were 1.3% down and food prices inflated by 0.2%. It’s interesting that food was the only section of retail to have higher prices in July 2014 compared to July 2013 (see Table).

There were more than a few column inches written about austerity and the lack of real wage increases being the cause of this first recorded fall in the volume of food bought. This may partially be the cause but there may also be other more positive explanations.

Some of the fall might be explained by a reduction in food waste and hopefully, this will have an impact on food sales in the future. Much has been made of the ‘best before’ dates increasing food waste and I am sure that they are understandably super-precautionary. My own experience suggests that yoghurts can be eaten a week after the ‘best- before’ dates with no ill effects! Another possible contribution to the fall in food volumes sold might be that we are eating less and hopefully better quality food because of the increasing concerns over obesity.

These newspaper articles encouraged me to look at the monthly reports on retail sales produced by the Office for National Statistics. Each report is huge with page after page of statistics and it is easy to be put off trying to read and understand it. However, there are very well written summaries for each retail sector and things become clearer after a while.

I picked up some interesting facts (well, they’re interesting to me!). In July 2014, for every pound spent in the whole of the retail industry (including online), £0.42 was spent in food stores, £0.41 in non-food stores, £0.06 pence in non-store retailing (e.g. mail order, catalogues and market stalls) and £0.11 in stores selling automotive fuel (i.e. petrol stations). This demonstrates that food still is the largest retail sector, but not by much. The only other of these main retail sectors to experience a fall in volumes over the year was ‘automotive fuel’ which fell by 4.7% (see Table). In fact the quantity of fuel sales seems to fall regularly, perhaps explaining the rapid loss of rural petrol stations.

Overall, online sales grew by over 11% over the last year. Only 3.7% of food sales were online in July 2014 compared to exactly two thirds of non-store retailing.

Food retailing seems to be in transition despite the relatively low proportion of online sales. The business sections of newspapers have all been giving the big food retailers advice on how to handle the fact that consumers are getting savvier and can now seem better able to work out if they are getting good value for their money. This means that consumers are becoming less loyal to one supermarket chain and as a consequence, they are less likely to do a ‘big shop’ at their previously favoured superstore. The supermarkets that are suffering are those that bridge the gap between the discounters (Aldi and Lidl) and the high end of the market (Waitrose and Marks & Spencer) [As an aside, I remember Alan Coren saying that Sainsbury’s existed to keep the riff-raff out of Waitrose]. A fall in the total volume of food sales is probably the last thing any food retailer needs, particularly those that are already suffering from decreased sales.

The general advice offered by the newspapers (as if they know best!) is that those supermarket companies that are stuck in the middle will have to become more price competitive and offer greater value. The papers also say that they will achieve this with lower margins and less spend on store refurbishment. Well, I hope that this is the case rather than further squeezing their suppliers. In many cases market prices for farmers are already below the cost of production and the room for a further squeeze on farm prices is just not there.